As many family offices in recent years have become more sophisticated, there has been a growing trend among these organizations to take advantage of diversified investment strategies. One popular option is direct investing.

Direct investing is the practice of investing directly in a company, instead of engaging the traditional services of brokerage houses, investment managers, wealth managers or financial planners.

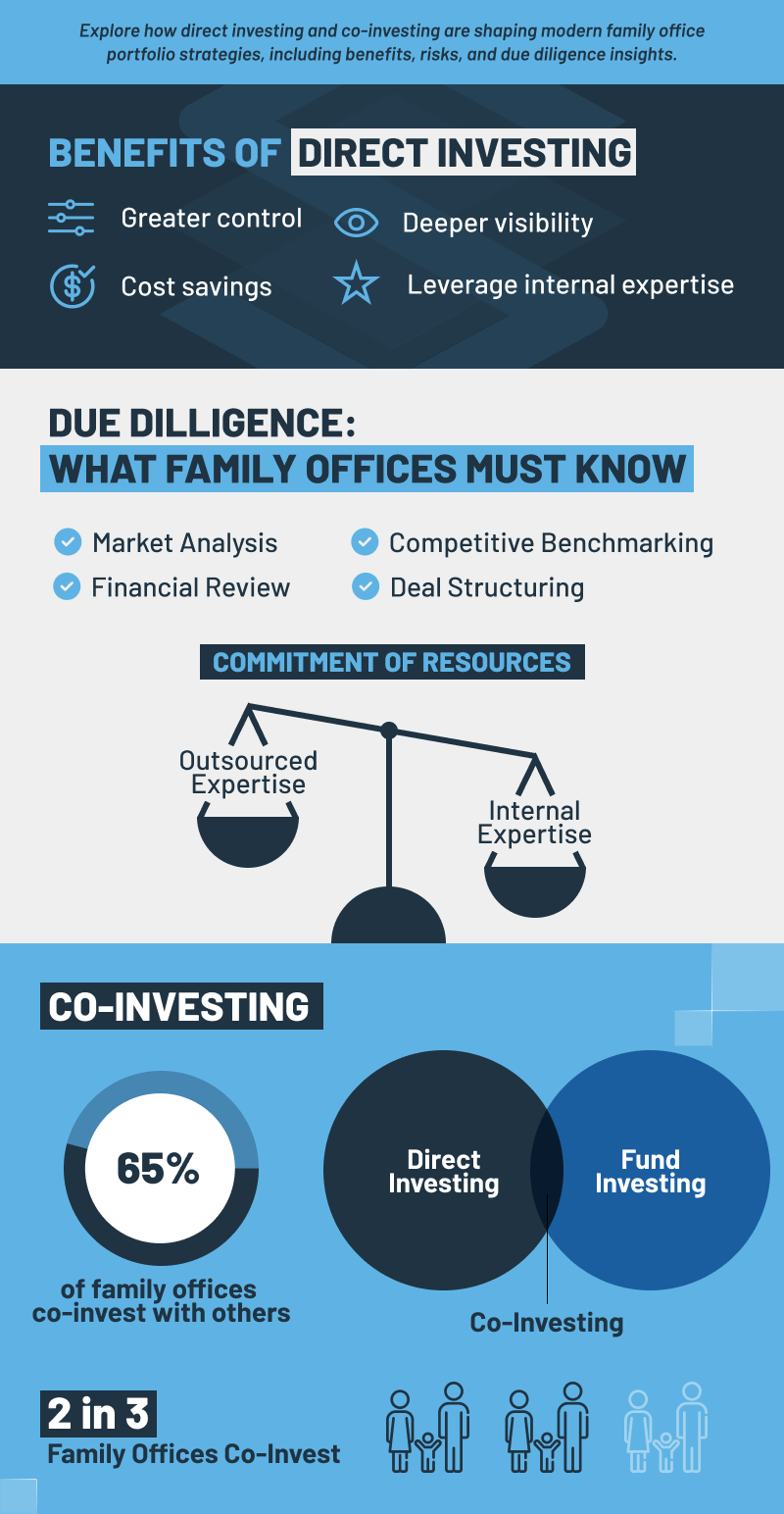

Advantages of Direct Investing for Family Offices

According to a 2023 report by FINTRX, about 69% of single family offices have utilized direct investments as a part of their portfolio strategy.

Direct investing provides a variety of advantages and benefits, including:

- Greater Control Over Investments: Direct investing provides family offices with more control over their investment choices, namely in the areas of deal terms, the negotiation of key business points, and when to enter or exit an investment relationship. It is important to note that family offices should have specialized knowledge about the business sectors in which they invest to successfully carry out these activities.

- Greater Visibility: The direct investing model gives family offices more insight and clearer visibility into their investments. Direct investing allows the investor to go straight to the investment source, instead of relying on a fund manager or other intermediary to gather data and decision points on their behalf.

- Significant Savings: Family offices do not have to pay management fees, and/or carried interest to an intermediary when engaged in direct investing (keep in mind, however, there will most likely be fees at the investment level). This savings can be significant over a long period of time.

- Internal Knowledge & Expertise: Direct investing allows family office staff to utilize their own expertise and business experience in choosing the best investments for the organization. Working with a fund manager can lessen the influence of such valuable resources.

Infographic: Comparing direct, fund, and co-investing models:

Direct Investing Cost & Risk Considerations

Along with the benefits that come with direct investing, family offices should be aware of the potential risks and costs associated with the strategy.

- Commitment of Resources: Direct investing requires a significant amount of work, time, and knowledge about the industry being considered.

- Due Diligence Responsibility: Conducting proper due diligence is time consuming, as in-depth market and financial analysis, as well as competition studies must be completed before any investment decisions are made.

- Lack of Internal Expertise: Some family offices may have to seek outside resources to make certain investments if they are not available internally, which in the long run can be very costly. However, external knowledge resources allow family offices to focus on their core capabilities and strengths.

The Concept of Co-Investing

In order to mitigate the costs and risks discussed above, family offices can also consider a co-investment approach to their direct investment strategy. Co-investing is defined as two or more organizations partnering together to share investment risks and costs, minimize losses, and gain access to additional industry expertise and a larger capital pool of funds. Co-investing can be accomplished with other family offices and/or independent sponsors.

Co-Investing with Other Family Offices

According to a Willaim Blair study, over 65% of family offices have co-invested with other family offices. By combining resources and capital assets through co-investing, family offices share their knowledge and expertise about diverse industries to better recognize attractive business opportunities, and potentially reap better returns.

Co-Investing with Independent Sponsors

Co-investing with independent sponsors also provides a number of notable advantages for family offices. Independent sponsors specialize in finding viable investment opportunities, and seeking out available capital. Family offices can greatly benefit from the experience, and expert financial analysis services independent sponsors offer. Additionally, collaborating with an independent sponsor allows a family office to “opt in” on attractive deals. This model still provides the freedom that comes with direct investing, but also delivers the added benefits of reducing costs, and minimizing potential risks.

Sadis is Here to Help

Direct investing as an alternative portfolio strategy has been growing in popularity with many family offices. However, before considering it as an alternative investment option, it is critical to understand both the benefits and risks involved before any decisions are made.

If you have any questions about direct investing, please contact Yehuda Braunstein at 212.573.8029 or via email at ybraunstein@sadis.com.